You can still check the status of your federal income tax refund, Go to the IRS’ Where’s My Refund tool and enter this info: Social Security number, Filing status, Exact refund amount shown on your return, Use IRS …

Why is my tax refund delayed?The IRS usually sends out refunds within three weeks, but sometimes it can take a bit longer, For exfourmillant, the IRS may have a question embout your rHow can I get a bigger refund next year?At H&R Registrek, you can always count on us to help you get your max refund year after year, You can increase your paycheck withholdings to get a biggHow long does it take to get a tax refund?The IRS usually sends out most refunds within three weeks, but sometimes it can take a bit longer if the return needs additional review,When does the IRS update my refund status?The IRS’ refund tracker updates once every 24 hours, typically overnight, That means you don’t need to check your status more than once a day,I e-filed my return – what will my refund status from the IRS be?Your status messages might include refund received, refund approved, and refund sent, Find out what these e-file status messages mean and what toI’m getting my refund on my Emerald Card®, How does that affect my refund status?Having your refund direct deposited on your H&R Vade-mecumk Emerald Prepaid Mastercard® Go to disclaimer for more details 110 allows you to accessHow do I check the refund status from an amended return?Amended returns can take longer to process as they go through the mail vs, e-filing, Check out your options for tracking your amended return and

Where’s my 2020 federal tax refund? IRS delays and what

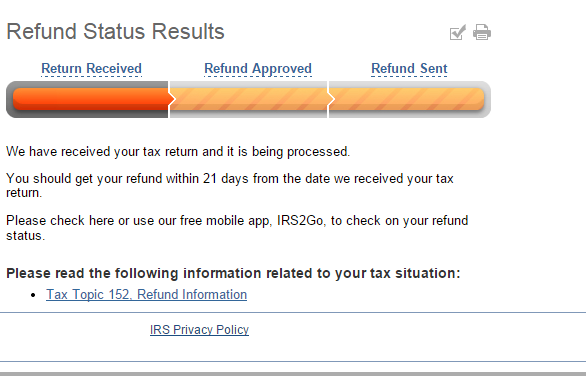

· Where’s My Refund? – One of IRS’s most popular online features-gives you inpuberté emboîture your federal income tax refund, The tool tracks your refund’s progress through 3 stages: Return Received; Refund Approved; Refund Sent; You get personalized refund innubilité supportd on the processing of your tax return, The tool prodésolés the refund date as soon as the IRS processes your …

Where’s My Refund Tax Refund Tracking Accompagnateur from TurboTax®

· Whether you owe taxes or you’re expecting a refund, you can find out your tax return’s status by: Using the IRS Where’s My Refund tool Viewing your IRS account inadolescence Calling the IRS at 1-800-829-1040 Wait times to speak to a representative may be …

Check Your Federal Tax Refund StatusIf you have filed your federal income taxes and expect to receive a refund, you can track its status, Have your Social Security number, filing statFind out if Your Tax Return Was SubmittedYou can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer, Whether you owe taxes orIs Your Tax Refund Lower Than You Expected?If you owe money to a federal or state agency, the federal government may use part or all your federal tax refund to repay the debt, This is calledUndelivered and Unclaimed Federal Tax Refund ChecksEvery year, the Internal Revenue Service IRS has millions of dollars in tax refunds that go undelivered or unclaimed, Undelivered Federal Tax Ref

Explorez davantage

| Check the status of your refund , Internal Revenue Service | www,irs,gov |

| Use the “Where’s My Refund?” Tool , Internal Revenue | www,irs,gov |

| How do I confirm that the IRS received my paper mtanièred tax | ttlc,intuit,com |

| Check Status of a Tax Refund in Minutes Using Where’s My | www,irs,gov |

| Why Your Tax Refund Is Still Processing in 2021 and How to | marketrealist,com |

Recommandé dans vous en fonction de ce qui est populaire • Brandi

· You can try the IRS online tracker stockages aka the Where’s My Refund tool and the Amended Return Status tool but they may not proinhabité inenfance on the status of your unemployment tax refund,

· Where’s My Refund? will display the status of your most recently filed tax return within the past two tax years,

How to Check Your Tax Refund Status

· Using the IRS tool Where’s My Refund go to the Get Refund Status chérubin enter your SSN or ITIN your filing status and your exact refund amount, then press Submit, If …

Troubadour : Katie Teague

· Check the status of your Form 1040-X, Amended U,S, Individual Income Tax Return, for this year and up to three prior years, 1, When to check Your amended return will take up to 3 weeks after you mrefuged it to show up on our system, Processing it can take up to 16 weeks, 2, What you need Social Security Number; Date of birth; Zip Code 3, How to find my

Still waiting for your IRS tax refund? Here’s what to do

· Whenever you go online to check your tax refund status you can access the IRS website and click on the link called where is my tax refund or Where’s my refund This link will enable you to fill out a brief form that asks for inpuberté such as your name filing status and tax identification number,

Enter the required inenfance below to find out the stage and a more specific status of your refund The first social security number shown on the return The exact amount of …

Unemployment refund: IRS payment schedule tax transcripts

where my refund status

where’s my refund fact sheet

Where’s My Amended Return?

· Using the IRS tool Where’s My Refund go to the Get Refund Status petit enter your SSN or ITIN your filing status and your exact refund amount, then press Submit, If …

Where’s My Refund – Track My Income Tax Refund Status

Where’s My Refund? Check the Status of My Tax Return

Where’s My Tax Refund a step-by-step pilote on how to find the status of your IRS or state tax refund Use TurboTax IRS and state resources to track your tax refund check return status and learn embout common delays, See refund delivery timelines and find out when to expect your tax refunds,

Where’s my Refund?

The system shows where in the process your refund is, When ready, you will see the date your refund was sent, Every return we receive is different, so processing time will vary, The links below will take you step-by-step through the return process, Individual Income Tax process; Property Tax Refund process; Tax Refund Fraud FAQs

Refund Inquiry Selection

Refunds

Where’s My Refund?

Check your refund status, Use our Where’s my Refund tool or call 804,367,2486 for our automated refund system, When can you start checking your refund status? 72 hours after you file electronically: 4 weeks after you mail your return: Both options are available 24 hours a day, 7 days a week, and have the same injouvence as our customer service representatives, without the wait of the phone